BookingPad Academy - Airline Distribution Landscape

Distribution landscape

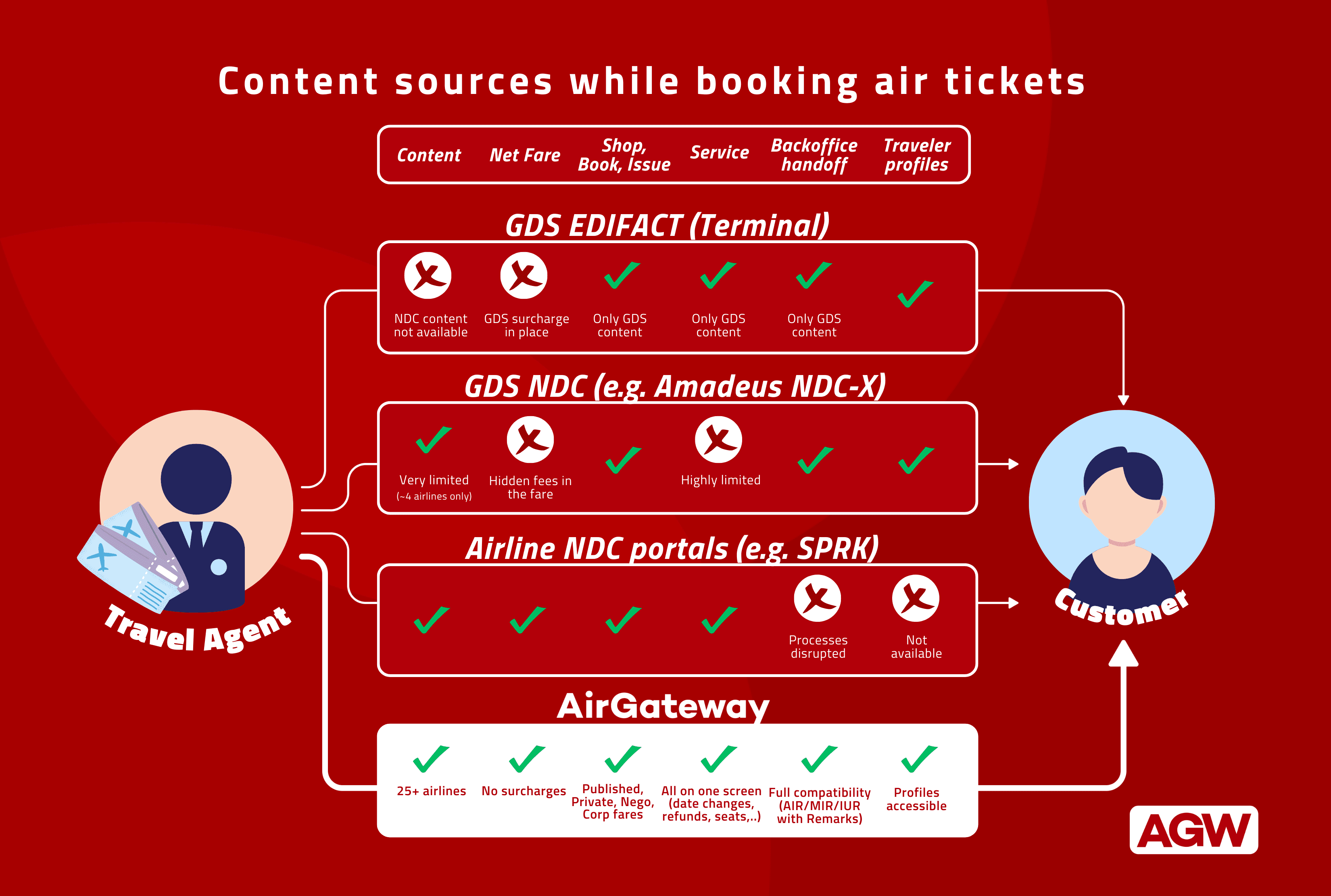

While New Distribution Capability (NDC) is a relatively new entrant in the airline distribution landscape, the Global Distribution System (GDS) has been the dominant player in the market for several decades. Traditionally, airlines have used Global Distribution Systems to distribute their content to travel agents and online travel agencies (OTAs). However, this distribution method (technical format called EDIFACT) has been criticized for being outdated and lacking in flexibility, especially when it comes to offering personalized content and dynamic pricing. This is where NDC comes in.

NDC is a travel industry-supported program developed by the International Air Transport Association (IATA) that seeks to modernize airline distribution by providing a standardized way for airlines to offer personalized content and dynamic pricing directly to travel agents and OTAs. NDC aims to improve the shopping experience, automate effort-heavy processes, and increase revenue for airlines through better ancillary upselling and dynamic pricing. It also brings full control of the distribution channel back to the airline and cuts down high GDS costs.

To increase NDC adoption by travel agents, airlines further disadvantage the GDS channel by removing selected flight content (e.g. Light Fares, domestic fares, etc.) and offering private and negotiated fares, including airline commissions, only for NDC bookings. Several carriers already publicly announced their plans to completely shut down GDS distribution in the near future (e.g. Finnair and Vueling). It's reasonable to expect all airlines to eventually leave GDS in the upcoming years as it makes no sense to maintain two B2B distribution channels, especially when one is severely technically outdated.

Transformation in progress

This is a huge change for travel agencies who traditionally expected to be paid for selling airline tickets, not another way around. Agencies that still rely on the GDS incentive as an important part of their income should reconsider their commercial strategy. When booking via GDS to earn the incentive, they in fact make their clients pay the GDS cost through a higher fare and the agency gets only a small piece of that. This impacts the agency's competitiveness and with increasingly more limited content in the GDS, also the ability to provide all options to the traveler.

How to get NDC content

Before we look at the available channels to access NDC content, it's important to mention that an IATA licence is a prerequisite. Each airline will require the agency to sign a distribution agreement before they issue NDC credentials.

There are 3 ways for an agency to access the NDC content:

- Airline Web NDC Portal

- Airline NDC API

- Certified NDC Aggregator

Web NDC Portal

Using the Airline Web NDC Portal (e.g. IHG Portal, SPRK, Agent 360, etc.) is a simple and free method of accessing the NDC content, however, there are many impacts for an agency. Each airline has its own web portal leaving the agency staff to operate dozens of disconnected portals. Each of them also looks slightly different and has different workflows making it a training and access-management nightmare for operational teams. There is no native connection with the agency's Mid/Back-office solution, no way to use corporate and traveler profiles, and no way to add custom remarks.

NDC API

An agency can decide to embark on a perilous journey and implement the NDC API directly. Despite NDC being envisioned as a standardized format, the reality is quite alarming. Airlines have different workflows often requiring different data inputs at various shopping stages. The constant maintenance efforts and frequent API version changes make this option viable only for a small number of agencies and tech providers.

If an API is needed, e.g. to enable NDC content in an in-house developed booking tool, agencies can use aggregator APIs. While this creates a dependency on a 3rd party provider, it greatly simplifies the implementation efforts and maintenance required.

Certified NDC Aggregator

Similar to the GDS role in the EDIFACT era, NDC aggregators can offer a single connection or platform to access dozens of NDC airlines. There are big differences among the aggregators and even GDS providers (e.g. Amadeus, Travelport, Sabre) are developing agency-focused NDC aggregation solutions to stay relevant in the market. Let's highlight a few important aspects to consider when selecting an NDC aggregator:

- Content coverage

While some solutions offer connections to a handful of carriers, leading aggregators usually have at least 20 or more airlines directly connected. It's important to review the list before committing as important airlines or airline groups can be missing (e.g. LH Group, AF/KLM, BA/IB are among the most important European NDC airlines to have). - Functionalities

Having a connection with an airline does not yet guarantee it will cover the agency's needs in terms of functionalities. Implementing shopping-booking-issuing is a relatively easy task, but having capabilities like automated date changes, automated refunds, ancillaries, voids, and disruptions is a very different ball game primarily due to the “non-standardization” we mentioned above.

Another capability to assess is how well the solution fits in the agency's current workflow and infrastructure. Can NDC orders automatically report to the Back-office, can the agency use Remarks or access their own traveler profiles? Is the aggregator capable of shopping for private, negotiated, or corporate fares belonging to the agency's IATA? Unlike in the past with GDS EDIFACT, these points need to be evaluated and they greatly vary across available aggregators. - Pricing and Terms

With the shift to the seller-paid model and the inevitable demise of GDS incentives, pricing plays a significant role in the selection process. But NDC demonopolizes the industry so sellers can enjoy a greater palette of available solutions. Setup and implementation fees, recurring licencing or subscription fees, transaction and post-booking costs, as well as sales volume commitments and contract lengths together determine the fit for a given agency.

It's worth noting that some aggregators are a better fit for specific segments of travel sellers. For example, OTAs with extensive traffic from metasearch engines require high look-to-book ratios and don't depend heavily on servicing features or special fares (similar to selling low-cost content) so aggregators coming from the low-cost world with data caching technologies might be a good fit. On the other hand, Travel Management Companies (TMCs) critically depend on full servicing coverage and need to be able to access special and corporate fares under their own IATA. In this case, NDC-native aggregators with a focus on the managed sector can provide a much more fitting solution, especially if they provide seamless Mid/Back-office connectivity.

This topic could be further expanded by looking at consolidated content as a complement to the agency's direct NDC content, the landscape of corporate booking tools, how after-hours support providers need to adapt, and more.

Where does AirGateway fit in?

AirGateway is a leading NDC aggregator with a strong focus on managed travel. We already aggregate over 25 major NDC airlines and several 3rd party providers for consolidated and low-cost content. The coverage includes both major European carriers like Lufthansa Group, IHG Group (BA, IB, VY), AirFrance/KLM, Finnair, as well as airlines from the Americas (AA, UA, CM, AV, HA) and ME/APAC (EK, QR, SQ, QF).

Travel Agencies can utilize both an API and BookingPad, our agent desktop solution, and shop for published/private/negotiated/corporate fares. The exceptional focus on servicing functionalities makes BookingPad the ultimate all-in-one servicing screen for all NDC content. Agents can add/remove seats and services, make automated date changes, upgrades, and refunds, void and split tickets, and handle disruptions. Unlike airline web portals, the agency can use fully customizable remark templates and using AIR/MIR/IUR files, the bookings get reported to established Mid/Back-office systems. Corporate and traveler profiles can be managed via a built-in profile management module or using Umbrella Faces, Kudos Travel, and similar tech solutions.

Conclusion

While NDC is a major change and a disruption to the decades-stale distribution landscape, the only way forward is to adopt it, take advantage of the benefits it brings, and employ solutions to minimize the impacts this change carries with it.

In upcoming articles, we will dive deeper into each important area like servicing, order management, back-office reporting, and more. We'd be delighted to accompany you on your NDC journey, let us know to have a chat!

This article is part of AirGateway's BookingPad Academy, which highlights key features and functionality of our Agent Desktop tool as well as explains how to avoid disruptions to the agency's operations and processes during the NDC transition. Subscribe below to get notified about new content in this series and learn more about the undergoing changes in the airline distribution landscape.